M&A Data Excel Integration

In today's fast-paced business environment, the integration of M&A data into Excel has become a crucial tool for financial analysts and corporate strategists. This seamless integration not only streamlines data management but also enhances decision-making processes. By leveraging Excel's powerful analytical capabilities, organizations can effectively analyze, visualize, and interpret complex M&A data, driving more informed and strategic business decisions.

Introduction

Mergers and acquisitions (M&A) are complex processes that require meticulous data management and integration. Excel, being a widely-used tool for data analysis, plays a crucial role in this context. However, integrating M&A data into Excel can be challenging due to the diverse sources and formats involved.

- Combining data from multiple sources

- Ensuring data accuracy and consistency

- Automating data updates and reporting

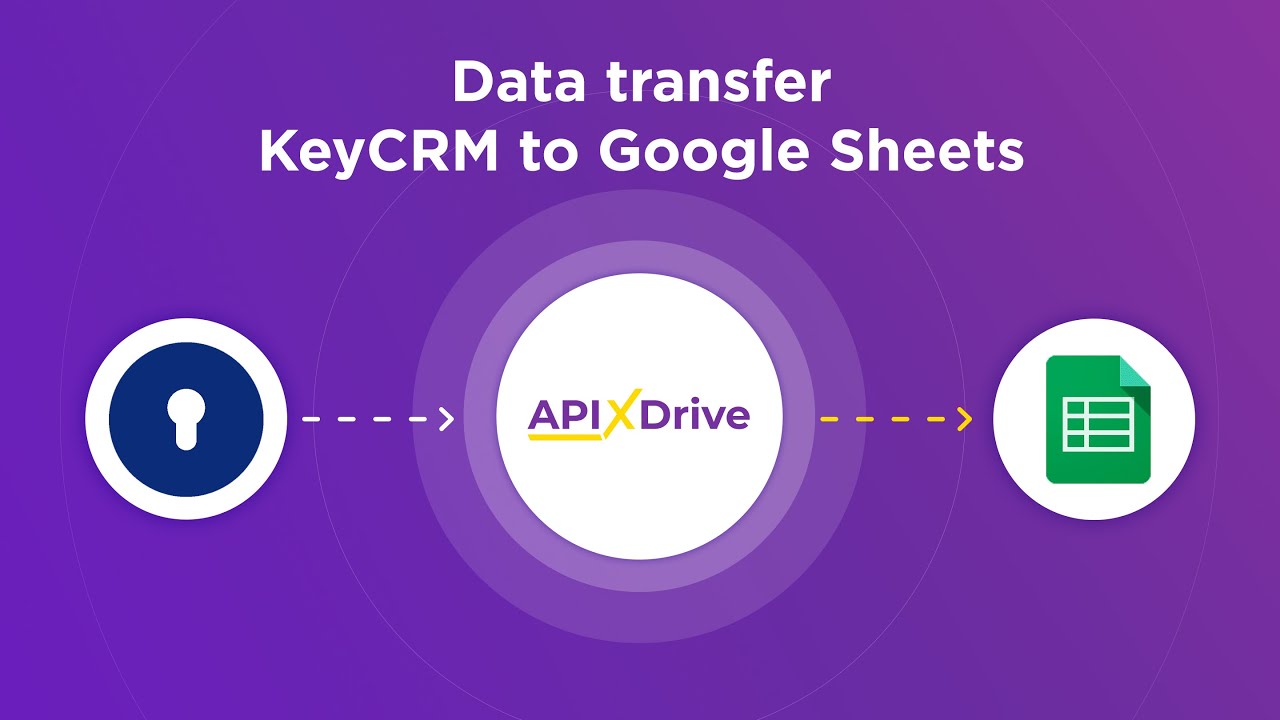

To address these challenges, businesses often turn to integration services like ApiX-Drive. This platform allows seamless data transfer between various systems and Excel, ensuring that M&A teams have real-time access to accurate information. By automating data workflows, ApiX-Drive helps streamline the M&A process, making it more efficient and less prone to errors.

Data Transformation and Preparation

Data transformation and preparation are critical steps in the M&A data integration process. Initially, raw data from various sources must be cleaned and standardized to ensure consistency and accuracy. This involves removing duplicates, correcting errors, and filling in missing values. Tools like Excel provide powerful functions and formulas to facilitate these tasks, enabling users to manipulate large datasets efficiently. Additionally, data normalization techniques are applied to ensure that the data is in a uniform format, making it easier to analyze and integrate.

Once the data is cleaned, it must be transformed to match the target system's structure. This may involve converting data types, aggregating information, and creating new calculated fields. Services like ApiX-Drive can streamline this process by automating data transformation tasks and integrating with various data sources. By leveraging such tools, organizations can ensure a seamless and efficient data integration process, ultimately leading to more accurate and reliable M&A analysis.

Excel Integration

Integrating Excel for M&A data can streamline the process of managing and analyzing large datasets. This integration allows for seamless data transfer, ensuring that all relevant information is up-to-date and easily accessible for decision-makers.

1. Connect your Excel spreadsheet to your M&A database using data connectors or APIs.

2. Automate data updates to keep your Excel file synchronized with real-time changes.

3. Utilize tools like ApiX-Drive to simplify the integration process and manage data flow efficiently.

By leveraging Excel integration, companies can enhance their data management capabilities, reducing manual efforts and minimizing errors. Tools like ApiX-Drive provide a user-friendly interface to connect various data sources, making it easier to maintain accurate and timely information. This enables better insights and more informed decisions during the M&A process.

Data Analysis and Visualization

Data analysis and visualization are critical components in the M&A process, allowing stakeholders to make informed decisions based on comprehensive insights. By integrating M&A data into Excel, users can leverage powerful tools to analyze trends, identify patterns, and visualize key metrics.

Excel offers a range of functionalities for data analysis, such as pivot tables, conditional formatting, and advanced charting options. These features help in summarizing large datasets, highlighting significant data points, and presenting information in a visually appealing manner.

- Pivot Tables: Summarize and analyze complex data sets.

- Conditional Formatting: Highlight important data trends and anomalies.

- Advanced Charting: Create dynamic charts and graphs for better visualization.

For seamless integration and automation of data from various sources, services like ApiX-Drive can be utilized. ApiX-Drive offers easy-to-use tools to connect different applications, ensuring that your Excel sheets are always up-to-date with the latest M&A data. This integration enhances the efficiency and accuracy of your data analysis and visualization efforts.

Conclusion

The integration of M&A data into Excel is a critical step for ensuring accurate and efficient data management during mergers and acquisitions. By leveraging advanced tools and methodologies, companies can streamline their data processes, enhance decision-making, and minimize the risk of errors. Excel, with its robust analytical capabilities, serves as an ideal platform for consolidating diverse data sources into a cohesive and actionable format.

To further optimize this integration, services like ApiX-Drive offer seamless connectivity between various data sources and Excel. ApiX-Drive simplifies the process by automating data transfers, reducing manual effort, and ensuring real-time updates. This not only saves time but also enhances the reliability of the data, enabling stakeholders to make informed decisions with confidence. Ultimately, effective M&A data integration in Excel, supported by tools like ApiX-Drive, is essential for achieving successful outcomes in the complex landscape of mergers and acquisitions.

FAQ

How can I integrate M&A data from multiple sources into Excel?

What are the benefits of automating M&A data integration in Excel?

Can I schedule automatic updates for my M&A data in Excel?

What should I consider when choosing a data integration tool for M&A data?

Is it possible to integrate real-time M&A data into Excel?

Do you want to achieve your goals in business, career and life faster and better? Do it with ApiX-Drive – a tool that will remove a significant part of the routine from workflows and free up additional time to achieve your goals. Test the capabilities of Apix-Drive for free – see for yourself the effectiveness of the tool.