5 Dynamically Growing Startups – 2023

Growth is an indicator that both startup founders and investors aim to increase. It gives businesses the opportunity to quickly establish themselves and create their own value in the market. We invite you to familiarize with the five fast-growing companies-startups as of the beginning of 2023.

What is Good Startup Growth?

For startups at an early stage, a monthly growth rate doesn't mean much because even a large percentage will still be a small number. For example, 10- and 20-percent growth at $100,000 ARR (Accounting Rate of Return) investors will evaluate as approximately the same indicators. Dynamics, however, is another matter entirely. A startup that grew by 10% in the first month, 12% in the second, and 15% in the third month shows that it is gaining momentum. Startups that have not yet reached $1 million ARR, but show monthly growth of the order of 15%-25%, are considered fast-growing startups and good candidates for investment.

The rate of reaching $1 million ARR

When looking at early-stage B2B startups, the biggest focus for investors is the speed with which they hit $1M ARR after launch. For example, if a company manages to show a jump to $500,000 ARR in the first 3 months after launch, it will impress them much more than a slow growth to $1 million ARR within 2 years. Going from 0 to $1 million ARR within a year or less is a great result.

Naturally, every rule has its exceptions. There are investors for whom

the speed of reaching $1 million ARR or the rapid growth within a year

after the launch is not critical. They look at cases of successful

companies that have been swinging for several years to reach excellent

growth rates. For example, if for the year the company's revenue

increased from $500,000 to $5 million ARR, then it doesn't matter when

it was launched – just a year ago or back in 2013. It is growing currently – this is the most important thing.

The rise of consumer startups

For early-stage startups that have opted for a B2C model, growth is typically not driven by revenue, but by engagement, popularity, and customer retention. In other words, the most important indicator here is the intensity of using the product and communicating about it.

Many investors primarily look at the involvement and retention rates of

such companies. Results that exceed 50% on DAU/MAU user activity metrics

or 50% on customer retention status on the 30th day from launch are

rated as excellent. If the company has managed to achieve both, then it

can be argued that it is one of the fastest growing startups.

We invite you to familiarize with 5 fast-growing cool startups that achieved success last year and are not slowing down this year.

Oddle

Location: Queenstown (Singapore)

Date of foundation: 2014

Founders: Yong Xiang Pua, Jonathan Lim

Funding: $9.7 million (Series B)

Investors: Altara Ventures, SPH Media Fund

Oddle is an e-commerce cloud service that gives food service companies the ability to manage takeaway orders and delivery

through their own online channel. The project started as a food delivery

platform and only in 2019 was reorganized on a revenue sharing model.

Today, it is a one-stop platform that helps F&B business owners to

digitalize their businesses. Startup Oddle provides low-cost,

productivity-focused solutions that deliver maximum value at minimum

cost.

The COVID-19 pandemic has triggered a surge in traffic on the platform due to increased demand for online food delivery orders. Many representatives of the F&B business have begun to actively digitize in order to at least stay afloat during quarantine restrictions. In 2019, Oddle had gross sales of $30 million, and in 2021 it jumped to $200 million. Today, over 1,500 catering companies in 7 countries use the Oddle online ordering platform. Among the most famous users are The Fullerton Hotel, the Lady M confectionery chain, the Hai Di Lao restaurant chain, the Udders ice cream parlor chain, and the Maki-San sushi restaurant chain. The company has offices in Malaysia, Taiwan, and Hong Kong.

Since 2014, Oddle has raised a total of $9.7 million in venture capital across 6 startup funding rounds. The another investment was received on May 18, 2022.

Perimeter 81

Location: Tel Aviv (Israel)

Date of foundation: 2018

Founders: Amit Bareket, Sagi Gidali

Funding: $165 million (Series C)

Investors: Entree Capital, Insight Partners

Considering the SaaS model to be the best option to enter the market in terms of profitability, Perimeter 81 built its network security solution on it and developed NaaS ("network as a service"). Perimeter 81 is a cloud-based VPN platform that gives businesses, regardless of size, the ability to provide secure access to the cloud, programs, and services not only to full-time employees, but also to their colleagues working remotely. The system has 2-factor authentication, split tunneling, allows you to manage permissions and perform DNS filtering.

With over 700 servers, Perimeter 81 functions as a unified platform that is ready to deploy secure cloud networks in minutes. More than 1,000 clients from more than 36 countries are connected to it, and using it, they are already saving more than 50% of their funds on cloud security.

Perimeter 81 – fast growing startup. Since 2018, the company has managed to raise a total of $165 million in venture capital across 6 startup funding rounds. Another major investment was received on June 5, 2022.

Bakkt

Location: Alpharetta, Georgia (USA)

- Automate the work of an online store or landing

- Empower through integration

- Don't spend money on programmers and integrators

- Save time by automating routine tasks

Date of foundation: 2018

Founders: Adam White, Kelly L. Loeffler, Mike Blandina

Funding: $932.5 million (Post Ipo Equity)

Investors: Goldfinch Partners, PayU

Bakkt is a fintech startup, one of the fastest growing tech companies. According to the developers, the main goal of its creation was to popularize cryptocurrencies and attract reputable investors from among world-famous companies to this area.

Bakkt is an online platform that is a global digital financial ecosystem. It gives registered users the ability to sell, buy and store cryptocurrencies, as well as perform settlement transactions with digital assets. In addition, Bakkt provides access to several popular tools: an internal payment system, wallets where you can store digital money, exchanges for acquiring cryptocurrencies, and custodial services.

At the IPO, Bakkt was valued at $2.1 billion. Since 2018, it has managed to raise a total of $932.5 million in venture capital across 3 startup funding rounds. Another major investment was received on October 18, 2021.

Linktree

Location: Melbourne (Australia)

Date of foundation: 2016

Founders: Alex Zaccaria, Anthony Zaccaria, Nick Humphreys

Funding: $165.7 million (Series C)

Investors: Michelle Kennedy, Greenoaks

Linktree – online multilink generation service. In 2016, it was the first on the market, and today it continues to hold the status of the largest. The main goal of developing the Linktree platform was to help influencers and content creators to share it on different resources through a single link in just a couple of clicks. Such a tool makes it possible to quickly and easily make a multilink and place it, for example, in the profile header on your Instagram.

The service has many additional useful features that allow you to choose the time of activation of the link, highlight the most important links, create a password, warning, or clarification of the age for content of various types. Users can also see analytics and generate commercial links (that is, those that make it possible to receive money from customers directly).

Since 2016, Linktree has raised a total of $165.7 million in venture capital across 3 startup funding rounds. Another major investment was received on March 16, 2022.

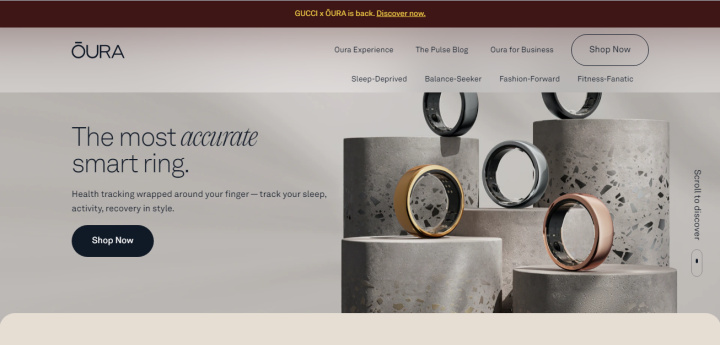

Oura Health Oy

Location: Oulu (Finland)

Date of foundation: 2013

Founders: Kari Kivela, Markku Koskela, Petteri Lahtela

Financing: $148.3 million

Investors: MSD Capital and Lifeline Ventures

Oura Health Oy is a Finnish med tech company. It is best known for Oura Ring, a titanium alloy “smart” ring that is used to monitor sleep quality and a number of physical health parameters. It collects data (body temperature, heart rate, sleep phases) around the clock, displays it in a smartphone application and makes recommendations based on it. The advantage of the Oura ring lies in its size – it is more compact and not as noticeable as other wearable gadgets with similar functionality, such as smartwatches.

In May 2021, Oura Health Oy's sales were just over 500,000 rings. At the time, the startup managed to raise a $100 million investment, but the valuation was not disclosed at the time. The release of the Gen3 model boosted sales. The new product provided more in-depth health reports, personalized recommendations, meditation exercises, educational videos, and more. By April 2022, the company has sold 1 million rings.

Since 2013, Oura has raised a total of $148.3 million in venture capital across 9 startup funding rounds. Another major investment was received on April 6, 2022.

Summing Up

2023 promises to be a very active and busy time for the newest startups as technology advances and online services continue to expand. We recommend that you closely monitor the development of the companies that we discussed – periodic innovations and confident scaling indicate that they have good potential.

If you founded one of the best new startups, it is significant to choose the optimal time to launch. As soon as your company

receives the first digits (for example, ARR), the countdown will begin.

It is from this moment that investors will begin to evaluate the rate of

growth. If you have already launched your startup, but the growth

dynamics are still rather low,

this usually means that it may be worth considering adjusting the strategy. Therefore, it is best to stand in the

"pre-launch" mode for a longer time to thoroughly prepare for

the launch. Then there are chances for the development of good dynamics

after the start and the achievement of $1 million ARR in an attractive

timeframe for investors.

Time is the most valuable resource for business today. Almost half of it is wasted on routine tasks. Your employees are constantly forced to perform monotonous tasks that are difficult to classify as important and specialized. You can leave everything as it is by hiring additional employees, or you can automate most of the business processes using the ApiX-Drive online connector to get rid of unnecessary time and money expenses once and for all. The choice is yours!